Market Rotation 2026 | Investors Shift from Tech to Broader Sectors

For most of the last year, the US market story was simple: tech led, everything else followed at a distance. That script is starting to change.

📈 The rotation is real

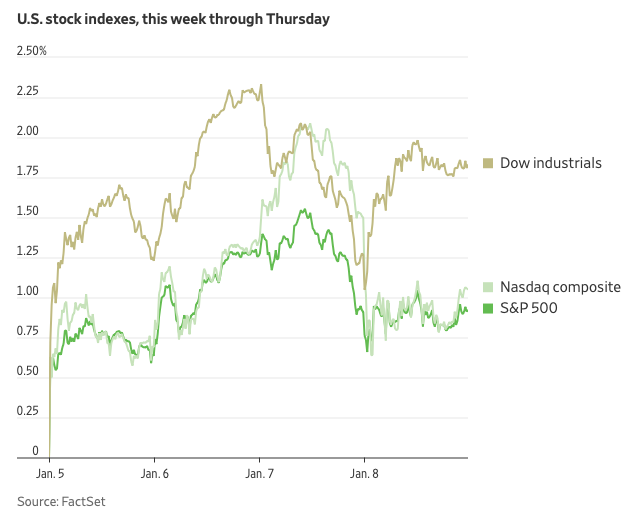

Early 2026 is starting with a classic rotation, as highlighted by The Wall Street Journal. Growing economic optimism is pushing investors beyond AI darlings and into defense, consumer, and industrial stocks. The Dow is flirting with 50,000, the Russell 2000 just hit a fresh record, and nine out of eleven S&P 500 sectors rallied on Thursday alone.

Defense stocks surged after Trump floated a $1.5 trillion military budget — more than $500 billion above current expectations. Consumer-discretionary and materials companies are leading the week’s gains. Meanwhile, small caps are finally waking up after months of tech dominance.

🧭 Why this matters

A narrow rally is like balancing on one leg — impressive, but unstable. A broader rally spreads the load. More sectors participating usually means less fragility and more potential opportunities.